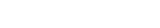

Performance

Morningstar Snapshot

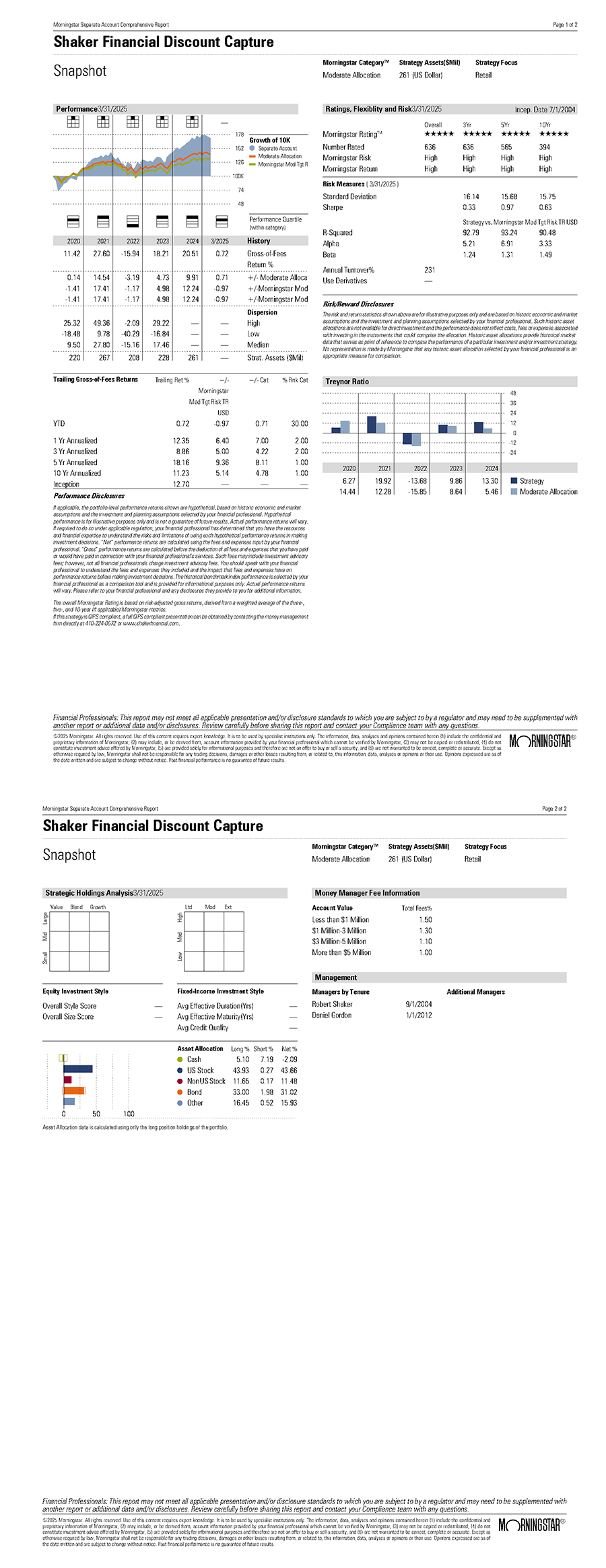

Return On Investment

As shown in the chart above, a $1,000 investment subject to the returns of the SFS Discount Capture Composite would have been worth $10,809 (after management fees and other expenses) on December 31, 2025, as opposed to the $4,068 returned by a moderately allocated investment with the same performance as the Dow Jones Moderate Portfolio Risk Index, the $9,071 returned by the S&P 500 Total Return with dividends reinvested, and the $2,010 returned by a bonds based investment with the same performance of the Bloomberg Aggregate Bond Index.

DISCLOSURES

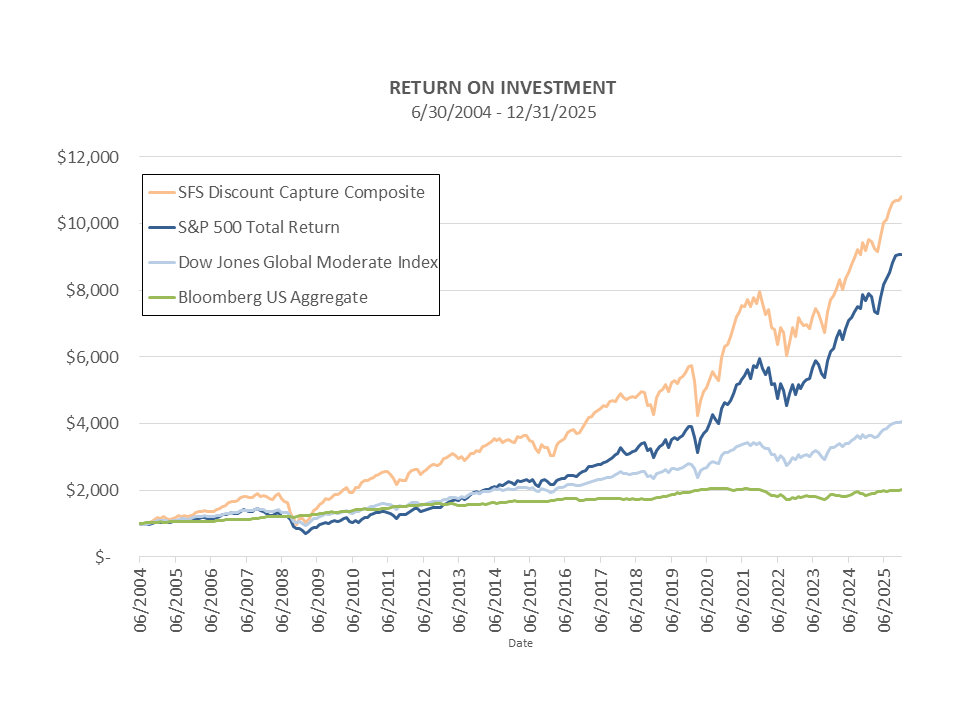

Annualized Performance

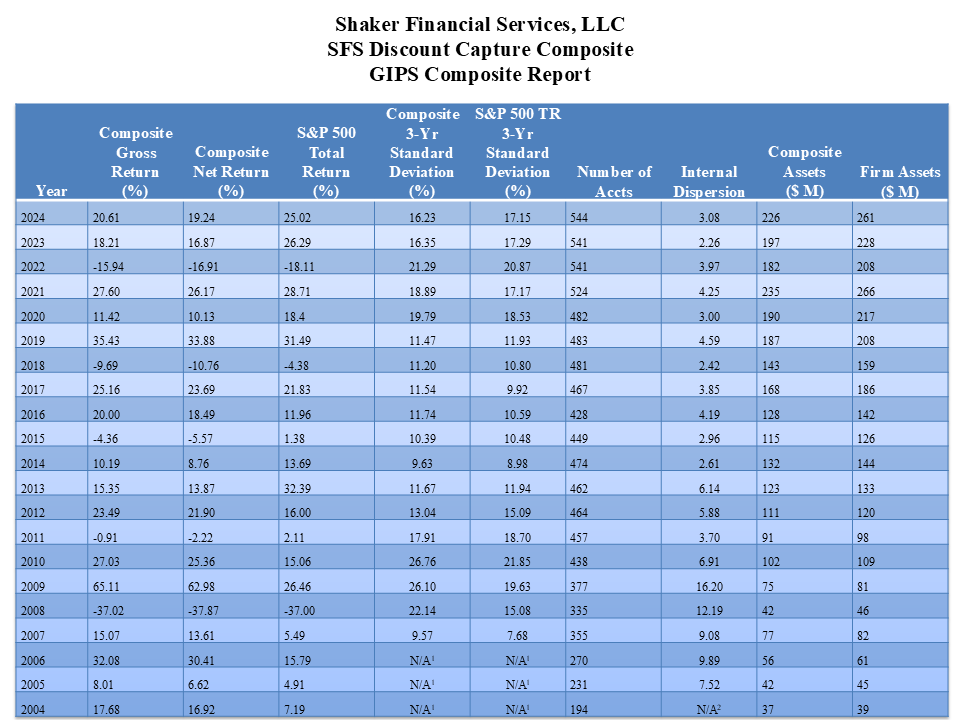

GIPS Composite Report

N/A1-Due to the timeframe of the data, these calculations are undefined.

N/A2 - Information is not statistically meaningful due to an insufficient number of portfolios in the composite for the entire year.

* Shaker Financial Services began fully utilizing Advent/Axys performance software in the second quarter of 2004. Accordingly, composite performance was incepted on July 1, 2004 and performance for 2004 is for the partial period from July 1, 2004 through December 31, 2004.

SFS Discount Capture Composite contains all discretionary, fee-paying accounts managed by Shaker Financial Services that participate primarily in closed end funds utilizing the core strategy of capturing discounts. The composite generally utilizes margin accounts to take additional long positions. The overall leverage for the composite is typically around 20%. For comparison purposes, the composite is displayed alongside the S&P 500 Total Return.

Shaker Financial Services, LLC claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Shaker Financial Services, LLC has been independently verified. The SFS Discount Capture Composite has been examined for the periods June 30, 2004 through December 31, 2024.

A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm's policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The SFS Discount Capture has had a performance examination for the periods June 30, 2004 – December 31, 2019. For the periods June 30, 2004 through March 31, 2017, independent verification was conducted by Ashland Partners & Company LLP. For the period March 31, 2017 through December 31, 2024, independent verification was conducted by the ACA Performance Services Division of ACA Compliance, LLC. The verification and performance examination reports are available upon request.

Shaker Financial Services, LLC is an independent registered investment adviser. SFS’s list of composite descriptions is available upon request. Results are based on discretionary accounts under management, including those accounts no longer with the firm. Composite performance is presented net of foreign withholding taxes on dividends, interest income, and capital gains. Withholding taxes may vary according to the investor’s domicile. Past performance is not indicative of future results. The annual composite dispersion presented is an asset-weighted standard deviation (net of fees) calculated for the accounts in the composite the entire year. The 3-year annualized ex post standard deviation is calculated using gross returns.

The U.S. Dollar is the currency used to express performance. Returns are presented gross and net of management fees and include the reinvestment of all income. Net of fee performance was calculated after deducting actual management fees. Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request.

The current investment management fee schedule for the composite is 1.5% for clients whose AUM is less than $1 million, 1.3% for clients whose AUM is more than $1 million but less than $3 million, 1.15% for clients whose AUM is more than $3 million but less than $5 million, and 1.0% for clients whose AUM is more than $5 million. Actual investment advisory fees incurred by clients may vary. The SFS Discount Capture Composite was created January 1, 1996.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.